Return Goods Authorizations (RGA) Processing Guide

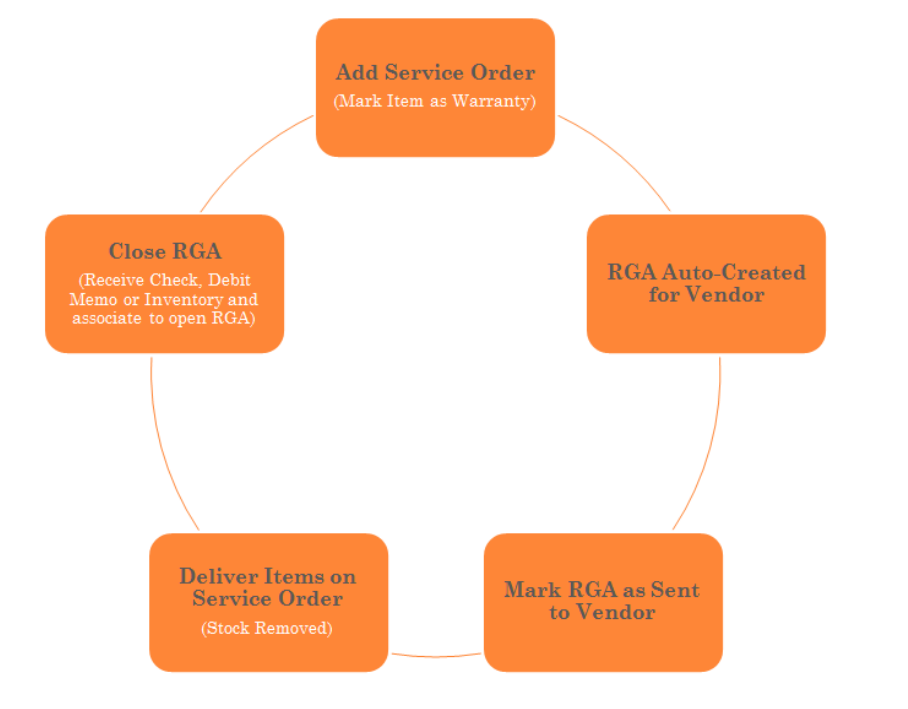

AUTO CREATED RGA PROCESS AND STOCK MOVEMENT:

Posting for Auto-Created RGAs

Example: Item Type = Stock or Non-stock Default Vendor Cost = $9.45 When sending the RGA, Accounts Receivable is debited for the default vendor cost and COGS is credited. Unit Cost does not matter since inventory is not removed when sending auto-created RGAs.

When receiving items on the RGA, the item is received at the original RGA cost. Typically, this is default vendor cost; however, you can change the item cost on the RGA. The item will be received at whatever cost is listed on the RGA so that AR is properly cleared out. Any additional receipts over the original amount are received at $0.00.

Posting for Other/Labor Type Items: Other and Labor Type items will debit AR and credit Warranty Income when the RGA is Sent.

MANUALLY CREATED RGA PROCESS AND STOCK MOVEMENT:

Posting for Manually Created RGAs

Example: Item Type = Stock or Non-stock Default Vendor Cost = $9.45 Unit Cost = $11.50 When sending the RGA, Accounts Receivable is increase for the default vendor cost since that is what you would pay if you were to purchase that item today; however, the item must be removed from inventory at current Unit Cost. Since default vendor cost can differ from Unit Cost, the difference is posted to the default COGS account for the item's product line.

When receiving items on the RGA, the item is received at the original RGA cost. Typically, this is default vendor cost; however you can change the item cost on the RGA. The item will be received at whatever cost is listed on the RGA so that AR is properly cleared out. Any additional receipts over the original amount are received at $0.00.

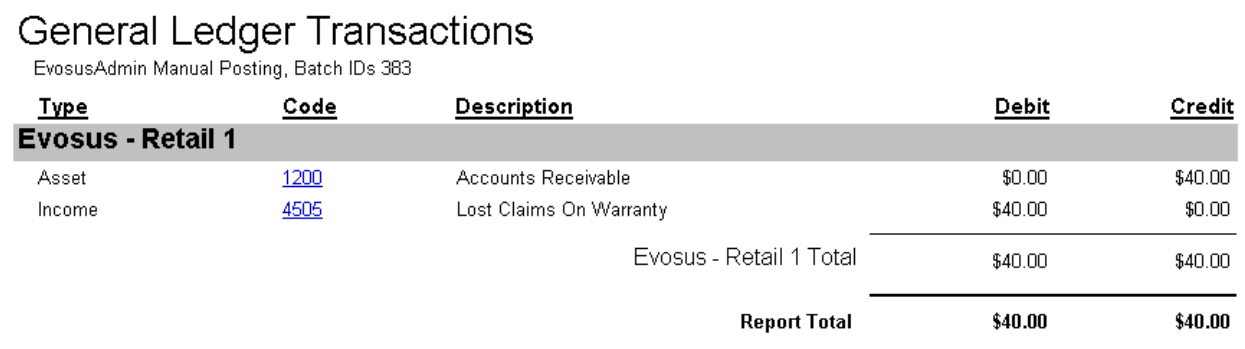

FORCE CLOSING RGA BALANCE:

There may be times when you need to force close an RGA. If the RGA has a balance the balance will post to your Lost Claims on Warranty default general ledger account.

-

This default account is setup under Administration > Accounting > General Setup > Accounts Defaults > Accounts Receivable Tab Below is an example of how the RGA will post to the general ledger when force closed with a balance:

RGA CLEAN-UP OVERVIEW:

Administration > Inventory > Return Goods Authorizations > Open New

-

RGAs in an Open New status in this search screen have had no effect on the general ledger. This makes the cleanup process very simple. From this screen simply highlight the RGA and click Cancel.

Administration > Inventory > Return Goods Authorizations > Open At Vendor

-

RGAs that have been marked as Sent to the vendor have posted to your accounts receivable general ledger account, since the vendor owes you money. If you have not associated any reimbursement receipts to the RGA you can highlight the RGA and click Cancel. Cancelling an RGA that is listed in the At Vendor status will reverse the original posting to the general ledger. See example below:

|

Transaction |

Debit |

Credit |

|

Mark RGA as Sent (at Vendor) |

Accounts Receivable |

Cost of Goods |

|

Cancel a Sent RGA |

Cost of Goods |

Accounts Receivable |

Administration > Inventory > Return Goods Authorizations > Open At Vendor

-

If you have associated a partial reimbursement to your open RGA you will not be able to cancel the RGA, instead you will highlight the RGA from this search screen and click Close. Force closing a RGA like this will post the remaining balance of the RGA to your Lost Claims on Warranty general ledger account.

-

The default Lost Claims on Warranty GL account is setup under Administration > Accounting > General Setup > Accounting Defaults > Accounts Receivable

Administration > Inventory > Return Goods Authorizations > Search and Apply RGA Receipts

-

This search screen displays all open receipt balances that have not been associated to an open RGA. You can force close receipts from this screen. If you choose to force close a receipt balance Evosus will debit Accounts Receivable and credit RGA Income.

RGA LOST CLAIMS REPORT:

Definition of Columns in Summary Report Based on Current Date Section Does not pay attention to date range selected on the filters screen. Displays data as of the current date.

-

Not Invoiced = RGAs that are in a new status and have not been marked as sent to vendor.

-

Balance Due = Current balance due on sent (invoiced) RGAs

Based on Date Range Section Uses the date range selected on the filters screen. Totals in this section are based on the specific activity that occurred in the date range selected. For instance, you could see Lost Claims figures for RGAs created three years ago, but were written off this month.

-

Unclaimed = RGAs that were cancelled in the date range.

-

Invoiced = RGAs that were Sent (invoiced) in the date range.

-

Claimed Paid = Credit, Check, or Inventory Received in the date range to reduce RGA balance.

-

Lost Claims = RGA balances that were written off in the date range.

Invoices and Closed in Date Range Calculates for RGAs sent and closed in the selected date range. Gives perspective on a vendor’s performance for paying on warranty claims.

-

Invoices = Sent (invoiced) RGAs in the date range that were also closed/Completed in that date range.

-

Claims Paid = Of the Sent (invoiced) RGAs in the date range, amount that was paid/reimbursed.

-

Lost Claims = Of the Sent (invoiced) RGAs in the date range, amount that was NOT paid/reimbursed.

Special Notes: Multiple versions of Report Available:

-

RGA Lost Claims Summary

-

RGA Lost Claims Summary Spreadsheet

-

RGA Lost Claims Detail

-

RGA Lost Claims Detail Spreadsheet

HELPFUL HINTS:

-

Auto-created RGAs (initiated from a customer order) will use the store associated to the originating transaction when posting the RGA.

-

The equipment installation date appears on the auto-created RGA print-out document.

-

If you need to edit a completed RGA go to Administration > Inventory > Return Goods Authorization > Search RGA > Closed. Search for your RGA and click Update. Once the RGA is open click Make Changes in the lower left corner. The Make Changes logic uses standard reverse posting logic.

Reverse posting will post as of original postdate:

Reverse postings can be posted when backdating the post. Currently, you have to post through the current date even through the transaction is backdated. - Same rules apply: cannot make changes if the accounting period is closed. - You will be prompted for a Stock Site when receiving items on RGAs. - You cannot add a quantity tracking item to a Sent RGA if negatives exist or if it will cause a negative.