Apply Tax to Vendor Invoice - Canada/Australia

Apply Tax to Vendor Invoice - Canada/Australia

There are two ways to apply tax to vendor invoices. You should only enter tax using one of these options. If you use both options on a single invoice, the tax will be applied twice.

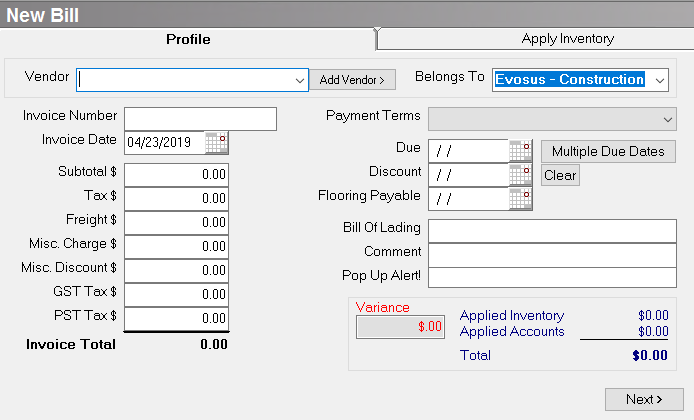

Option 1: Profile tab of the New Bill screen

Use the Tax, GST Tax, and PST Tax fields on the Profile tab of the New Bill screen (Administration > Accounting > Accounts Payable > Enter Bill). This allocates tax by invoice total.

-

Make sure the Invoice Subtotal does not include the tax amount! - When entering an amount in a tax field, make sure the Invoice Subtotal does not already include the tax amount.

-

Tax, GST tax, and PST tax is posted based on the GL account set up using the Accounts Payable tab on the Accounting Defaults screen ( Administration > Accounting > General Setup > Accounting Defaults).

-

Will the tax amount appear on the Sales Tax Due Report? The tax entered in these fields will only appear on the Sales Tax Due Report if the GL accounts associated with the tax fields on the Accounts Payable tab on the Accounting Defaults screen are also associated with at least one tax authority. For example, the amount entered in the GST Tax field will only appear on the Sales Tax Due Report if the GL account selected in the GST Taxes Paid field on the Accounting Defaults screen is also selected in the Tax Liability Account field on the Tax Authority screen on at least one tax authority.

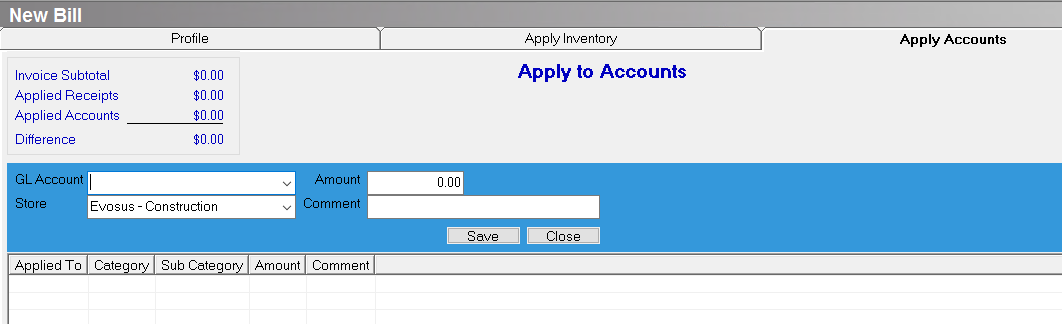

Option 2: Apply Accounts tab of the New Bill Screen

Use Apply Accounts tab on the New Bill screen (Administration > Accounting > Accounts Payable > Enter Bill). This allows you to allocate tax by GL account entry rather than the invoice total.

-

Make sure the Invoice Subtotal on the Profile tab includes the tax amount! - The application will calculate the tax amount based on the invoice subtotal and the tax code selected in the Tax Code field on the Apply Accounts tab on the New Bill screen.

-

Show Tax Details! - Click the Show Tax Details button on the Apply Accounts tab on the New Bill screen to view the calculated tax amounts. These are the same amounts that will display on the Sales Tax Due Report.