Configure Accounting Defaults

Use the Accounting Defaults screen to set up the defaults on Accounts Receivable, Accounts Payable, Inventory, Accounting, and Finance Charges (Administration > Accounting > General Setup > Accounting Defaults). Defaults include default posting accounts for the above areas, inventory costing methods, and the beginning month of the financial year.

Accounts Receivable

Select default posting accounts to use for Accounts Receivable. Select an account from the pull-down menu associated with that Accounts Receivable department. All accounts in the Chart of Accounts are located in the pull-down menu.

-

Accounts Receivable (ASSET): Select the default posting account for Accounts Receivable. This is the account that tracks all sales on account for customers.

-

Customer Order Freight (REVENUE): Select the default posting account for freight that is added to an order. This only applies if you have activated the freight field on sales and service orders. If you use a line item for adding freight onto an order, the freight totals will not roll into the Freight GL Account unless you assign it at the Product Line level.

-

Customer Deposits (LIABILITY): Select the default posting account for customer deposits. Customer deposits are payments made on an order. Deposits are removed from the Deposit Liability account once the order is invoiced.

-

Discounts Given (CONTRA-REVENUE): Select the default posting account for AR Discounts on invoices. AR Discounts are generally given when a customer pays an invoice before the due date. Payment terms such as 2%10/Net30 indicate a 2% discount will be granted if the customer pays within 10 days. AR Discounts are entered on the Payment screen. Note: While this account is a revenue type account, it carries a debit balance. This is often referred to as a contra-account (carries an opposite balance of what a normal account in that group would carry).

-

Finance Fee (EXPENSE): Select the default posting account for Finance Fees. A finance fee is considered to be the amount of money the financing company charges for their services. It is usually taken out of the payment they make to you for the customer's order.

-

Bad Debt (EXPENSE): Select the default posting account for Bad Debt. If a customer fails to pay you for an invoice, you can choose to close the invoice with a bad debt. The remaining unpaid balance on the invoice will post to the Bad Debts account.

-

Petty Cash (ASSET): Select the default posting account for Petty Cash Asset. If a transaction is conducted in petty cash and money is added then that transaction would post to the Petty Cash Asset account.

-

Petty Cash (EXPENSE): Select the default posting account for Petty Cash Expense. If a transaction is conducted in petty cash and money is withdrawn then that transaction would post to the Petty Cash Expense account.

-

Warranty Income (REVENUE): Select the default posting account for RGA/Warranty Income. All income that is received through RGAs (Return Goods Authorizations) would post to this account. If you do very little warranty work for vendors, you may decide to set this account up as a cost of goods sold. In that capacity, it would be a contra-account (an expense type account carrying a credit balance).

-

Warranty Lost Claims (REVENUE): Select the default posting account for lost claims on warranty. RGA's closed with a balance due will post the balance due to the Lost Claims account.

-

Refunds (REVENUE): Select the default posting account for Refunds. Straight refunds not associated to an invoice will post to this account.

-

Hold Back-Restock Fee (REVENUE): Select the default posting account for Holdbacks (restocking fees). Holdbacks can be entered when performing a refund for a customer. Holdbacks will post to this account.

-

Account for "Finance" Payment Method: Select the default posting account to use when entering a "Finance" type customer payment method. This posting account will be used anytime the associated payment method is used. Examples are "Customer Finance Receivable".

-

Account for "Other" Payment Methods: Select the default posting account to use when entering an "Other" type customer payment method. This posting account will be used anytime the associated payment term is used.

-

Miscellaneous Income (REVENUE): Select the default posting account for miscellaneous income. This account is used when a Deposit is forfeited on an order (the customer does not receive a refund on a deposit when an order is canceled).

-

Gift Certificate Liability: Select the default posting account for Gift Certificate Liability. When a gift certificate is used the money earned is posted to this account. If you sell gift certificates, you must also set up an inventory item that posts to this same account. As you sell certificates, the liability will increase. As you redeem gift certificates as payment methods, this account will decrease.

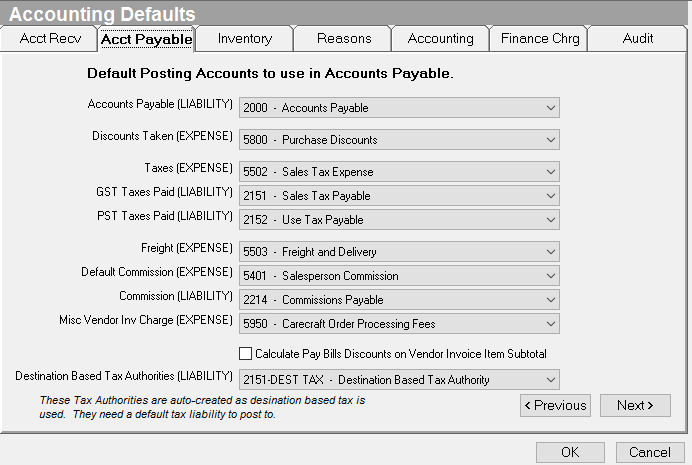

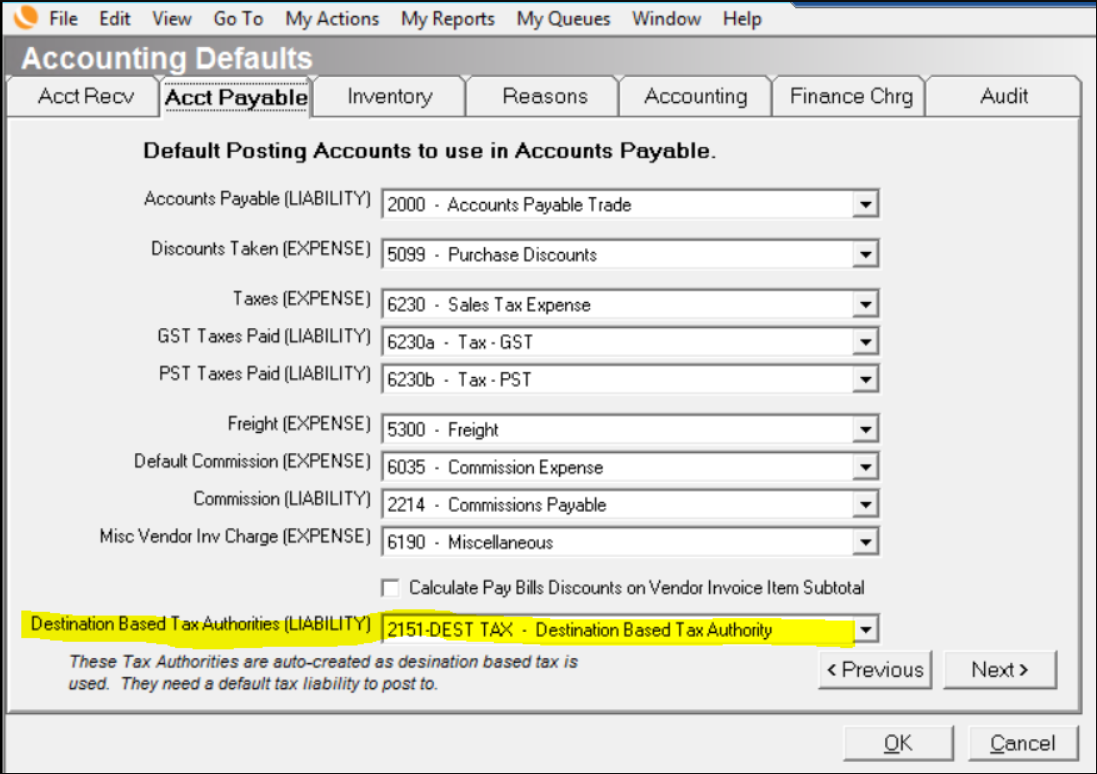

Accounts Payable

Select default posting accounts to use for Accounts Payable. Select an account from the pull-down menu associated with that Accounts Payable department. All accounts in the Chart of Accounts are located in the pull-down menu.

-

Accounts Payable (LIABILITY): Select the default posting account for Accounts Payable. By default, all vendor invoices are posted to this account.

-

Payroll Clearing (LIABILITY): Select the default posting account for Payroll Clearing. This will be used once Evosus is integrated with AC PayrollRelief.

-

Discounts Taken (CONTRA-EXPENSE): Select the default posting account for Discounts Taken. This account is for discounts taken off vendor invoices.

-

Taxes (EXPENSE): Select the default posting account for taxes. Tax entered on vendor invoices is posted to this account.

-

GST Taxes Paid (EXPENSE): Select the default posting account for GST taxes. GST tax entered on vendor invoices will be posted to this account.

-

PST Taxes Paid (EXPENSE): Select the default posting account for PST taxes. PST tax entered on vendor invoices will post to this account.

-

Freight (EXPENSE): Select the default posting account for freight. Freight that is added onto vendor invoices would post to this account.

-

Commissions (EXPENSE): Select the default posting account for commissions paid. All commissions that are paid out of Evosus® will default to this account.

-

Commissions (LIABILITY): Select the default posting account for commissions to be paid. All commissions that are paid out of Evosus will default to this account. This account will be reversed once the checks are written.

-

Misc. Vendor Invoice Charge (EXPENSE): Any fees or charges added to an invoice that is not accounted for by one of the above accounts.

-

Calculate Pay Bills Discounts on Invoice Item Subtotal: Checking this box will use the Subtotal rather than the invoice total to calculate discounts on vendor invoices.

-

Destination-Based Tax Authorities (LIABILITY): When you upgrade to version 6.7.301 you'll have an additional setting under Accounting Defaults, Administration > Accounting > General Setup > Accounting Defaults > Acct. Payable tab. The new setting is called Destination Based Tax Authorities (Liability) and will be assigned the auto-created GL account referenced above. This is the account that auto-created tax authorities will post to when using Destination Based Tax.

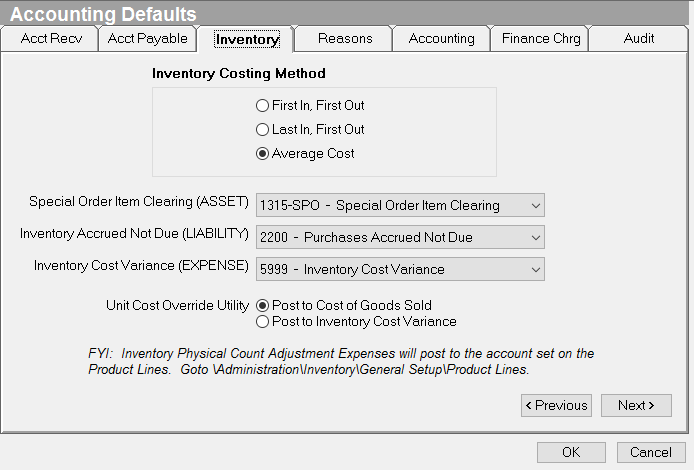

Inventory

Select default posting accounts to use for Inventory. Select an account from the pull-down menu associated with that Inventory department. All accounts in the Chart of Accounts are located in the pull-down menu.

-

Inventory Costing Method: Select the Inventory Costing Method. Options are "First In, First Out," "Last In, First Out," and "Average Cost."

- FIFO: An inventory term meaning First-in-First Out. A method of valuing inventory and cost of goods sold under which the items purchased are assumed to be sold first.

- Last-in-first-out (LIFO): A method of valuing inventory and cost of goods sold under which the items purchased last are assumed to be sold first.

- Average Cost Method: A method of valuing inventory and cost of products sold; all cost, including those in beginning inventory, are added together and divided by the total number of units to arrive at a cost per unit.

-

Inventory Accrued Not Due: Select the default posting account for Inventory Accrued Not Due. Purchases received prior to receiving an invoice are posted to this account. When the items are associated with an invoice, Evosus® automatically transfers the amount due from Inventory Accrued Not Due to Accounts Payable

-

Inventory in Transit: Select the default posting account for Inventory in Transit. Items currently in transit on Inter-Company Purchase Orders will post to this account. This account will be cleared out once the inventory is received at the requesting stock site.

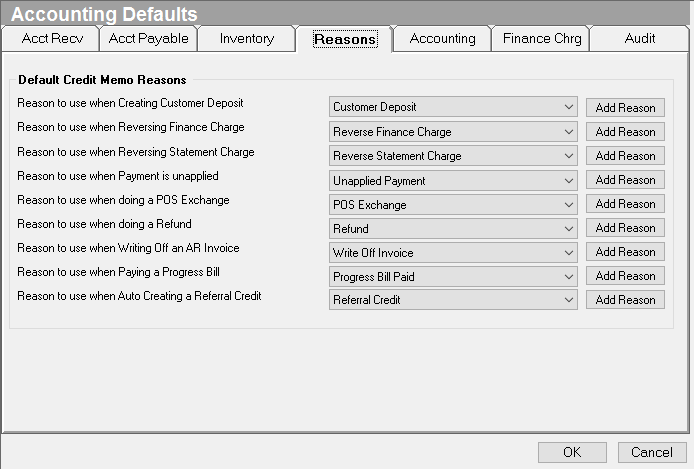

Reasons

Credit Memo Reasons are set up to help you track the purpose of a particular Credit Memo. There are 8 default reasons that will print on a credit memo when the credit memo is auto-generated by the system. These default credit memo reasons are TEXT messages only and are used to display a reason for auto-generated credit memos (such as Unapplied payment, Reverse Finance Charge and Write off Invoice). The default Reasons do not post to the associated GL code. The only time these reasons will post to the assigned GL code is when the credit memo is manually created.

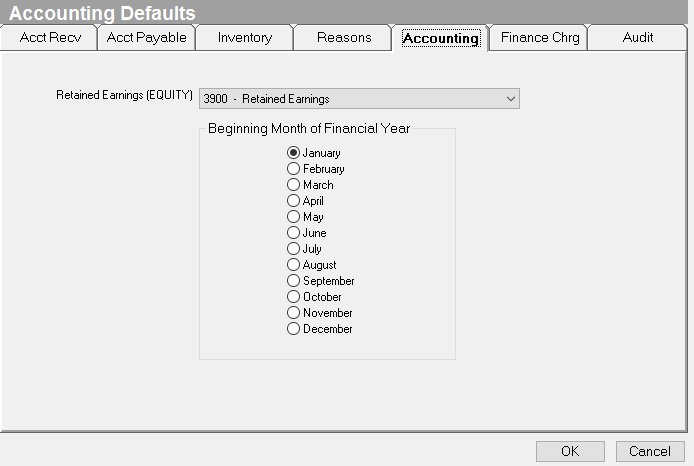

Accounting

Select default posting accounts to use for Accounting. Select an account from the pull-down menu associated with that Accounting department. All accounts in the Chart of Accounts are located in the pull-down menu.

-

Company Name: This is the legal name of the company that will appear on your financial statements and other reports. Check with the owner, your accountant, or from old tax forms to determine the correct name.

-

Retained Earnings: Select the default posting account for Retained Earnings. All income and expense accounts close out to this account at year-end. There is no specific closing process, rather, Evosus® knows to calculate this balance based on report dates selected.

- Retained Earnings: The sum of every dollar a company has earned since its inception, less any payments made to shareholders in the form of cash or stock dividends.

- Beginning Month of Financial Year: Select the month that begins your financial year. If you are unsure of this date, check with your accountant or other company staff.

- Fiscal Year: A 12-month period starting on a date any date in a calendar year and ending 12 months later. The fiscal year is generally January 1st through December 31st.

Finance Charges

Use the Finance Charges tab on the Accounting Defaults screen to set up the APR, Minimum Charge, Grace Period and default posting account for new finance charges.

- Open the Finance Charges tab.

2. APR: Most organizations select 16% or 18%.

3. Minimum Charge: Minimum amount the customer is charged regardless of the finance charge calculation.

-

For example, if the minimum charge is $2.50 and the system calculated finance charge is $2.00, the system will automatically charge the customer $2.50.

4. Grace Period: Number of days after the due date the system will wait before assessing finance charges.

-

Finance charges are assessed on all days past due including the grace period.

5. Select a calculation type

-

Balance Due Minus Finance Charges: Existing finance charges will be excluded from the calculation of new finance charges.

-

Total Balance Due (Including Finance Charges): Existing finance charges will be included in the calculation of new finance charges.

6. Display Name: Text that will appear on invoices and statements, e.g. Finance Charges or Late Fee.

7. Finance Charge (Revenue): Select a default finance charge GL account. The system will post finance charges to this account.

8. Customer Types: Select the customer types the finance charge applies to.

-

Only the selected customer types appear on the Assess Finance Charges screen when invoices are overdue.

9. Click OK to save your changes.

-

Now that the finance charges are set up, you can use the Assess Finance Charges screen to assess finance charges on customers with overdue transactions.

Audit tab

The Audit tab displays all of the changes that have been made to the Accounting Defaults screen, including who made the change and when the change occurred.

Security Permissions Required

| Category | Function |

| Administration – Accounting | *Can Access Accounting Tree Branch |

| SETUP - Accounting Defaults |