Create a Tax Authority

Tax authorities are the taxing agents you pay the tax too. The tax authority determines the following:

-

Tax rate

-

How the tax is calculated

-

How the tax is applied.

Create a Tax Authority

- Open the Tax Authorities tab on the Accounting Setup screen (Administration > Accounting > General Setup > Tax Authorities).

- Click Add.

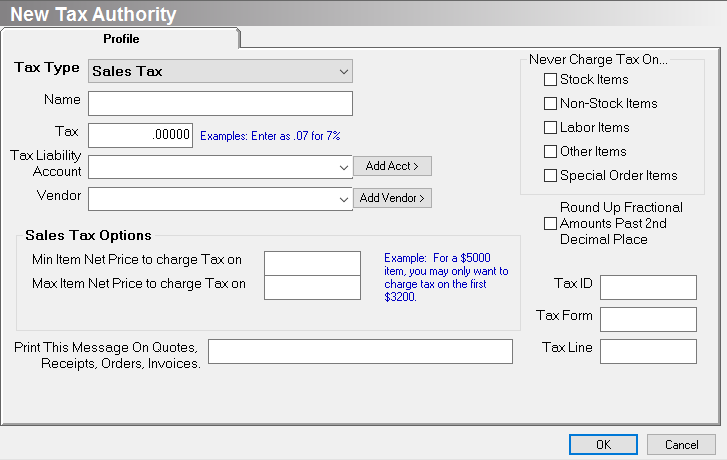

- Tax Type - This field determines how the tax is calculated, and which tax authority options are available.

- Use Tax - Not Collectable - Select this option if you do not want to pass the use tax on to the customer. The tax is calculated and postponed, but it does not increase the invoice amount. If you select this option, you have to select a Use Tax - Not Collectable Expense Account. This account is where the application posts the expense that is not passed on to the customer.

- Name - Enter the name of the Tax Authority. This name appears on the Sales Tax Due Report.

- Tax - Enter the decimal percentage of the tax rate (example: .07 = 7%).

- Tax Liability Account - For example, select the sales tax payable account.

- Click Add Acct to create a new account to the Chart of Accounts. We recommend that you have one account for each tax authority.

- Vendor - If the vendor is not listed in the pull-down click Add Vendor to add a new vendor. This is simply a reference field.

- Sales Tax Option

- If the tax authority has a ceiling on items it can charge tax on, enter the maximum item price. In other words, the amount of taxes charged will only be on the amount up to the ceiling. This is per item. Example: Maximum is $1200. On a $300 item, Evosus will charge tax on $1200 of the item.

- If the tax authority has a minimum amount it can charge tax on, enter the minimum item price. Example: Minimum is $1200. On a $3000 item, Evosus will charge tax on $700 of the item.

- Entering a Min and a Max means Evosus will start charging tax at the minimum amount, but will only tax any amount up to the maximum. Example. The minimum is $1200 and the Maximum is $3200. On a $1000 item, Evosus will charge no tax. On a $3000 item, Evosus will charge tax on $2000. On a $4000 item, Evosus will charge tax on $2800.

- Enter a message you would like to print on quotes, receipts, orders, and invoices anytime this tax authority is used. Typically, this is used for Australian tax authorities.

- Never Charge Tax On - Select which items the tax does NOT apply to.

- Check this box if the tax authority does not require reporting on exempt items - The item type is not marked as exempt, and the items will not show on the Sales Tax Due Report.

- Do not check this box if the tax authority requires reporting on exempt items - Do not check the box. Instead, make sure the Apply Tax if Applicable box on the Options tab of the Item screen (Inventory > Open an item > Options tab) is not checked. This will mark the item as not taxes on the order, and the exempt item will appear on the Sales Tax Due Report in the Not Taxed section.

- Round Up Fractional Amounts Past 2nd Decimal Place - For example, $9.642 is rounded up to $9.65 instead of rounding down to $9.64.

- This option is only used in specific states, and it should only be selected if you know this is a requirement of the state tax authority.

- Do not check this box until you confer with Evosus Support.

- Tax ID, Tax Form, Tax Line - Informational purposes only. These fields only appear on this screen.

- Click OK to save.

- Once the tax authorities are created, you can create the tax code.

Security Permissions Required Related Reports

-

Sales Tax Due (Administration > Reports > Accounting > Accounts Payable > Sales Tax Due) - Report on the Sales Tax Due for a given date range. The report can be broken out by the Tax Authority.

-

Sales Tax Due (Canada, Australia) (Administration > Reports > Accounting > Accounts Payable > Sales Tax Due) - Sales tax report that includes Accounts Receivable and Accounts Payable transactions. The Report can be run on the cash or accrual basis.