Create Your First Accounts Payable Credit Card Reconciliation

What if you don't have any credit card liability GL account activity prior to implementing the AP Credit Card Reconciliation feature in Evosus?

You must transfer the balance of the existing account to a new account via journal entry prior to implementing the feature. Review the steps below for creating your first AP Credit Card Reconciliation to ensure the first reconciliation will balance.

-

The new AP Credit Card Reconciliation process requires you to select a Statement Begin Date on the very first reconciliation you create in Evosus. The purpose of this date is to identify how far back Evosus should go in bringing in old, unreconciled transactions.

-

On the first credit card reconciliation, Evosus will not bring in unreconciled transactions older than the statement begin date. For some Evosus clients, this could be thousands of transactions if you select a date too far in the past. So, when selecting the first reconciliation period for your credit card, we would recommend starting with the most recent credit card statement cycle.

-

The first step towards completing your first credit card reconciliation is to create a new general ledger account(s) for reconciling your AP credit cards in Evosus. You will create a journal entry to move the balance out of the old account and into the new account as of the first date of the statement period for which you will begin using the AP Credit Card Reconciliation feature in Evosus. You will then use the Add Credit Card Charge feature in Evosus to record credit card charges throughout the statement period. You will use Write Checks to record payments made to the credit card during the statement period.

-

When you create your first reconciliation in Evosus, you will select the date of your journal entry as the Statement Begin Date. This will bring in the journal entry you created rather than thousands of historical transactions.

How to Create & Reconcile Your First AP Credit Card Reconciliation

- Identify the date range of your credit card statement period, such as March 25th –April 24th.

- This information is available on the statement from your credit card vendor.

- Identify the date you want to start using the new AP Credit Card process in Evosus.

- It is best to start this process at the beginning of a statement period, such as March 25th.

- Identify the balance in your current credit card liability account as of the date you anticipate making the transition to the new process.

- You can find the balance by running the Trial Balance or the General Ledger report. In our example, the existing account number is 2215 and the balance as of March 25th is $5,000.

-

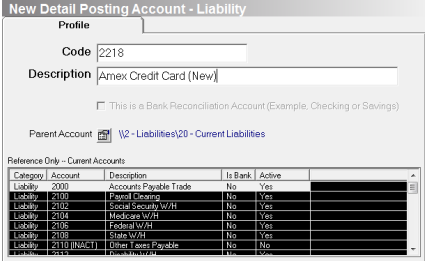

Create a new credit card liability general ledger account for reconciliation.

-

Go to Administration > Accounting > General Setup > Chart of Accounts.

-

Locate the Liability>Current Liabilities section where your credit card accounts are located.

-

Click Add Detail Posting Account.

-

Enter the new account number and a description of the account.

-

In our example, we will create a new GL account number 2218 for our American Express card.

-

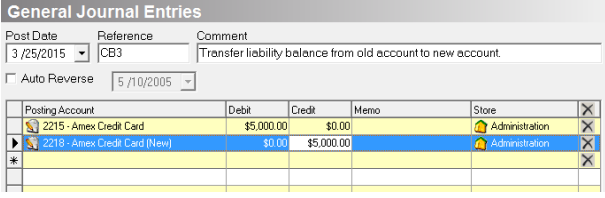

Create a journal entry to move the liability balance from the old account to the new account.

-

Remember, this should be dated for the first day of your statement period - such as March 25th.

-

In our example, we’re moving $5,000 from account 2215 to account 2218 as of March 25th.

-

Post the journal entry to the general ledger.

-

Go to Administration > Accounting > Initiate Posting.

-

Create the new Payment Method for the Credit Card.

-

Go to Administration > Accounting > General Setup > Payment Methods.

-

Click Add.

-

Enter a name, such as American Express Card.

-

Select Payment as the Category.

-

Select Credit Card as the Type.

-

Select your NEW liability account from the drop-down menu.

-

Click OK to save.

-

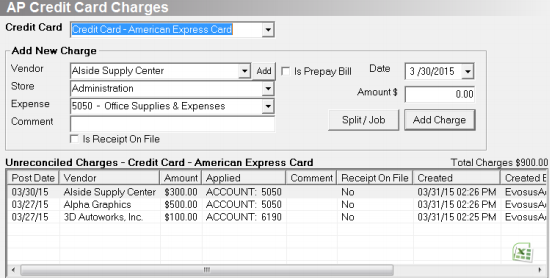

Start adding credit card charges using the Add Credit Card Charges feature in Evosus.

-

Go to Administration > Accounting > Accounts Payable > Add Credit Card Charge.

-

In our example, we’re adding three charges for $100, $500 and $300.

-

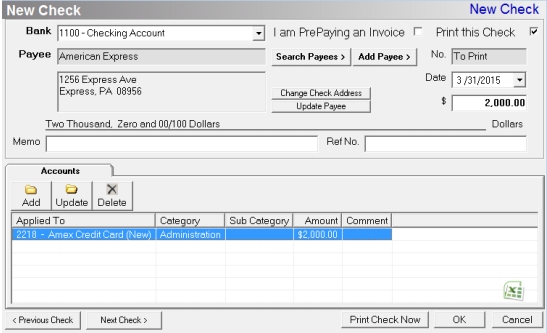

Make payments to the credit card using Write Checks.

-

Go to Administration > Accounting > Banking > Write Checks.

-

Select your credit card vendor from the list.

-

Make sure the Pre-Pay box is unchecked.

-

Enter the payment amount.

-

Select the credit card liability account in the Accounts grid.

-

Click OK to save.

-

In our example, we’re making one payment for $2,000.

-

Post to the general ledger AT LEAST through the statement end date once you receive the statement from the credit card vendor.

-

Go to Administration > Accounting > Accounting Desk > Initiate Posting.

-

Start the AP Credit Card Reconciliation once you receive your statement from the credit card vendor.

-

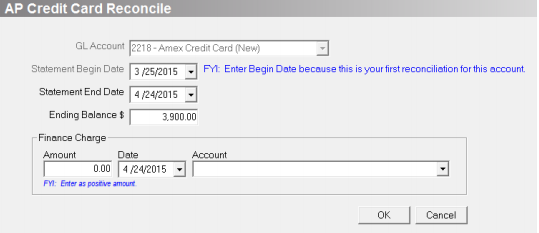

Go to Administration > Accounting > Accounts Payable > Reconcile Credit Card Statement.

-

Click Add.

-

Select your NEW GL account from the drop-down menu.

-

Select the statement begin date. This should be the same date as the Journal Entry you created in Step 5 above.

-

Enter the Statement End Date as indicated on the statement from your vendor.

-

Enter the ending balance as indicated on the statement from your vendor.

-

Enter any applicable Finance Charges as indicated on the statement from your vendor.

-

Click OK to save. In our example, we select the new GL account of 2218 and our Statement Begin Date of 3/25/2015. The Statement End Date is 4/24/2015.

-

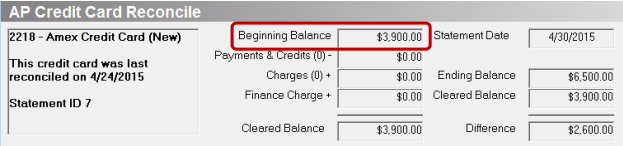

When the Reconciliation is generated, you’ll notice the beginning balance is $0.00.That is OKAY for the first reconciliation!

-

Check the box next to the balance transfer journal entry. You cannot reconcile the statement if this transaction is left unchecked.

-

Finish reconciling the statement by comparing the charges recorded in Evosus to the statement from the credit card vendor.

-

In our example, we checked the box next to the journal entry we created for $5,000. We also checked the boxes next to the three credit card charges and the $2,000 payment. Our cleared balance was $3,900 which matched the statement balance.

-

Click Statement is Reconciled once the difference is $0.00 and you satisfied with the results.

-

Next month, you will not be required to enter a Statement Begin Date and Evosus will automatically calculate the Beginning Balance based on the Ending Balance from the prior reconciliation.

-

In our example, the Ending Balance from our first reconciliation was $3,900. That’s the Beginning Balance for our next reconciliation.