Customer Credit Memos - Adding, Voiding, Unapplying

This article goes over manually adding a new customer credit, voiding customer credit memos, and how to unapply credit memo from a transaction.

Use the Credit Memo tab to add an account credit to a customer’s account or make adjustments to existing credit.

Credits are created via Return refunds or manually added through the CR Memo tab. Credits can be applied to transactions such as invoices, statement charges, finance charges, and POS transactions.

Adding A New Customer Credit Memo

-

Open the New Credit Memo screen (Customers > Select customer > Credit Memos tab > Click add OR Admin > Accounting > Accounts Receivable > Add Credit Memo > Select customer).

-

Amount: Input the credit memo amount.

-

Reason: Determines the GL account used on the credit memo.

-

Credit memo reasons are created and maintained using the CR Memo Reason tab on the Accounting Setup screen (Administration > Accounting > General Setup > Credit Memo Reasons).

-

The Reason I want to select does not appear! - When manually creating a credit memo, credit memo reasons set up as Accounting Defaults will not appear in the drop-down menu. Credit Memo Reasons are set up as Accounting Defaults using the Reasons tab on the Accounting Defaults screen (Administration > Accounting > General Setup > Accounting Defaults).

-

Store: Select a store.

-

(optional) Comment: The comment will not print on customer-facing documents. Use this field for internal comments.

-

(optional) Print on Document: This will print on the credit memo receipt.

-

Memo#: Automatically populates, but you can change the memo number if necessary.

-

Date: Date the credit memo is posted to the GL. By default, this is the current date.

-

This Credit Memo Expires: Check this box if the credit memo will expire after a specific date.

-

The credit cannot be applied after the expiration date.

-

Click OK to save.

Void (Write Off) Credit Memos

You should only void a credit memo if either of the following is true:

- The credit should be completely removed from the account.

- The Credit Memo was posted and you cannot make certain adjustments, such as store or date.

Credit memos that are closed, partially applied, or created through a deposit cannot be voided. If the Credit Memo is posted it can no longer be updated and must be voided.

-

Highlight the Credit Memo you are voiding.

-

Click Options.

-

Select Write Off Balance.

-

Click Yes to confirm.

-

"Enter Reason For Memo Write Off" and click OK.

-

Click OK again.

Important Note: A reverse posting will be created if the Credit Memo was posted prior to voiding.

What to do if the Credit Memo was created through a deposit:

-

You will need to void the payment associated with the deposit.

What to do if the Credit Memo is closed or has been partially applied:/span>

-

Refund the Credit Memo using "Check" as your Method, then perform a reversing Journal Entry to debit the bank General Ledger account and credit the General Ledger account associated with the Credit Memo reason. Go to Administration>Accounting>General Setup>Credit Memo Reasons to locate the associated General Ledger accounts.

-

Remove the check from the Print Check Queue.

Unapply a Credit Memo from a Transaction

You cannot unapply credit memos for the following reasons:

-

Credit Memo is applied to POS transaction

-

Credit Memo was created from Return Invoice

-

Credit Memo was applied to data conversion invoice

-

Credit Memo is voided

-

Credit Memo or associated transaction is in a closed accounting period

-

Credit Memo was created from customer payment (unapplied payment which creates credit memo)

Credit memos can be unapplied from invoices, progress bills, statement charges, and finance charges. Deposit credit memos can also be unapplied which will create a reverse posting to move the deposit back to the deposit liability account.

-

Open the Credit Memos tab on the Customer screen (Customers > Select a customer > Credit Memos tab).

-

Highlight the credit memo you wish to unapply.

-

Click Update.

-

Open the Reference tab.

-

Highlight the transaction you wish to unapply from the credit memo (if there's more than one).

-

Click Unapply Amount.

-

Click OK to save.

-

The credit memo is now open and available to apply to another transaction.

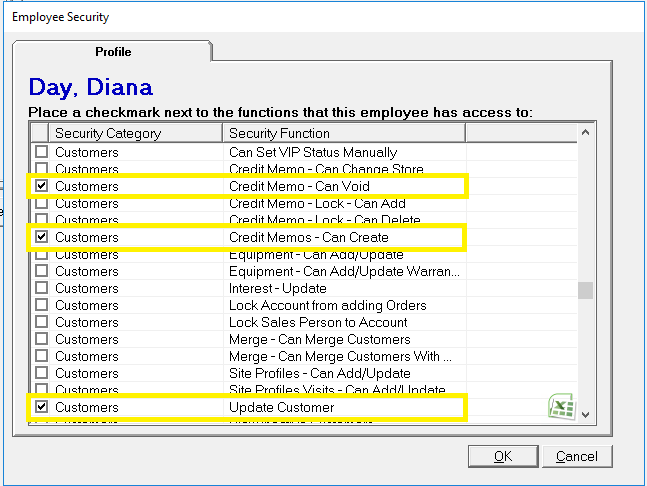

Security Permissions Required

Related Reports

-

Credit Memo Usage (Administration>Reports>Accounting>Accounts Receivable>Credit Memo Usage) - This report displays deposits and credits entered and used in a given time frame. The report can be filtered to include and exclude deposits or credits.

-

Customer Deposit Liability (Administration>Reports>Accounting>Accounts Receivable>Customer Deposit Liability) - Report displays open deposits as of a specific date. The report can be run as of a backdate and used to tie out the deposit liability general ledger account.

- Accounts Receivable Aging (Administration > Accounting > Accounts Receivable > Accounts Receivable Aging) - View all customers with an outstanding balance as of a specific date. The report shows days past due and the amount owed.

Related Video Content: