Destination Based Tax

Starting with version 6.7.301, Evosus is integrated with Zip-Tax to provide clients Destination Based Tax (DBT). This integration includes a web API real-time lookup of tax rates for customers in the United States only based on the customer's zip code in their Ship To address in Evosus.

Important Note:

- Destination-Based Tax (DBT) is for US clients only

- DBT is not available to select within Point-of-Sale or Store Setup for the POS Tax Default

- DBT is for Sales Tax only

- Customer Profiles cannot be assigned DBT as their Tax Default

If Destination Based Tax is needed on a quote/order, simply go to the Profile tab and choose "Destination Based Tax" in the Tax Code drop-down menu. In a matter of seconds, Evosus send the customers Ship To address zip code to Zip-Tax and creates the proper tax authorities in Evosus to ensure the correct tax rate is calculated. The new Tax Authority will instantly appear in the Tax Code field where you initially selected Destination Based Tax. See the screen shown below as an example.

Destination-Based Tax was selected in the Tax Code field, Evosus immediately replaced it with "PA 18938 6% BUCKS" which stands for "State - ZipCode - Calculated Tax Percentage - County Name"

The necessary Tax Authorities and Tax Codes are being created in the background automatically, so taxes can be tracked properly, but these codes/authorities are not visible in the Tax Code or Tax Authority General Setup screens; however, you can filter by these Tax Authorities and Codes in your Tax Reporting.

Is There Anything I Need To Do In Order To Start Using Destination Based Taxes?

#1 Upgrade to version 6.7.301 with the help of your Client Success Manager.#2 Create a Destination Based Tax Code. Follow the instructions below to complete this step.

Adding My Destination Based Tax Code:

Step 1: Go to Administration > Accounting > General Setup > Tax Codes and click AddStep 2: Enter a Tax Code Name such as DBT (Destination Based Tax)

Step 3: Check the box " Destination Based Sales Tax Rate based on Ship to Address.

Tax Code Setup Important Note:

- Once the DBT box is checked, you'll notice you are unable to select any Tax Authorities. Tax Authorities will be auto-created for you each time DBT is selected on a quote/order under the Profile Tab. While the authorities are auto-created you will not see them in this screen moving forward, only in your reporting.

- If Tax Authorities are checked off before the DBT box is checked, then once the DBT box is checked all Tax Authorities will be unchecked and grayed out.

- Once the Tax Code is set up and saved, it cannot be edited, only inactivated.

- Destination-Based Tax (DBT) is for Sales Tax only.

How Does Destination Based Tax Impact Evosus Accounting?

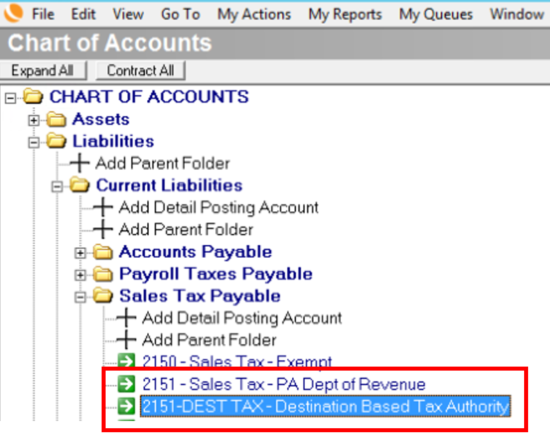

New Tax Liability GL Account:

When you update to Evosus version 6.7.301, the update script will automatically add a new Tax Liability GL Account to your chart of accounts. This is the account that auto-created tax authorities will post to when using Destination Based Tax. During the upgrade, Evosus identifies the Sales Tax Code used most often then copies that GL code while adding an extension of " - DestTax" to the end of the description. For example:

- GL Code "2151 - Sales Tax" is your most used sales tax gl account.

- A second GL code titled "2151-DestTax" would be created during the Evosus version upgrade.

Evosus users with proper permissions are welcome to inactivate that account should they not want/need to use Destination Based Tax.

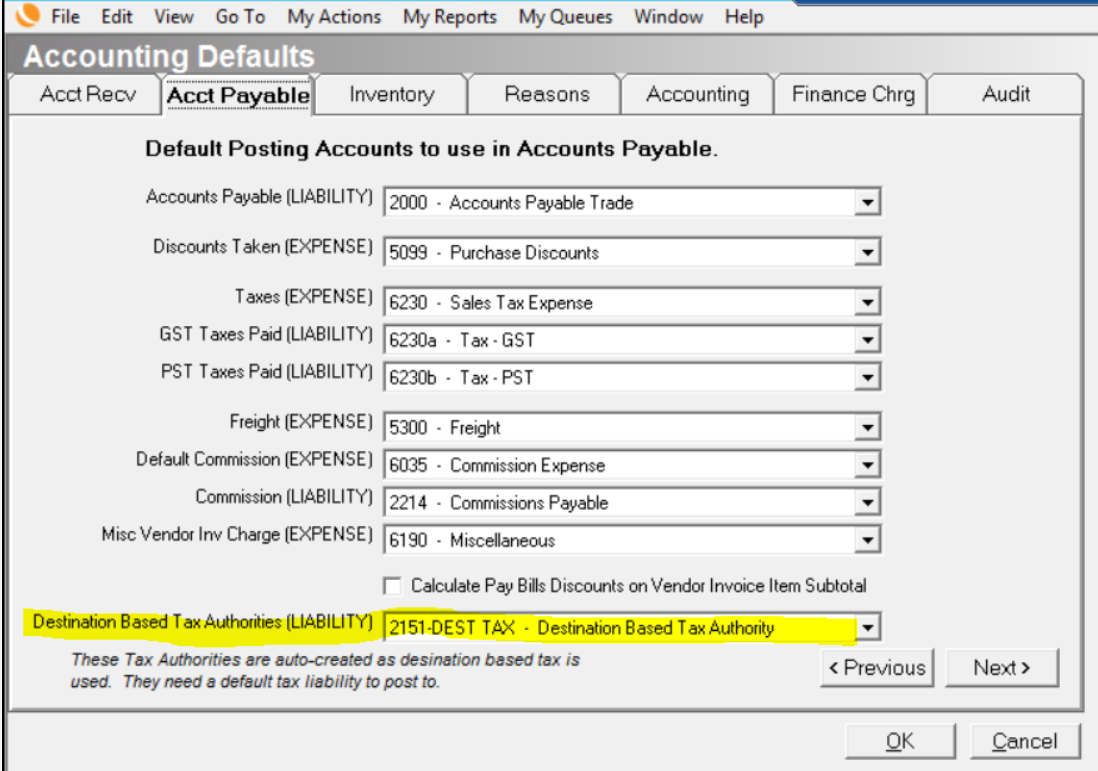

New Setting Under Accounting Defaults:

When you upgrade you'll have an additional setting under Accounting Defaults, Administration > Accounting > General Setup > Accounting Defaults > Acct. Payable tab. The new setting is called Destination Based Tax Authorities (Liability) and will be assigned the auto-created GL account referenced above. This is the account that auto-created tax authorities will post to when using Destination Based Tax.

Important Note: If the customer's Ship to Address is changed after the initial DBT has been calculated and assigned, you will receive a notification that open quotes or orders exist. In order to calculate the appropriate tax based on this new Ship to Address make sure to return to the Quote/Order Profile tab and again select Destination Based Tax in the drop-down menu. Evosus will immediately verify the new address record with Zip-Tax to assign the appropriate Tax Code.

Using Destination Based Tax (DBT) Impact Quotes and Orders

- DBT is calculated based on your customer's Ship to Address selected on the Quote or Order. Because of this, your customer's address needs to be complete and valid.

- If DBT is going to be used on the order, it needs to be selected on the Profile tab of the quote/order. After that is set, each line item can be edited to have a different tax rate if its something other than DBT. The Order Tax Code on the Profile tab needs to remain DBT if any part of the order is DBT.

- If DBT is selected on the profile tab, the necessary Tax Authorities and Tax Codes are auto-created for you. If you then changed the Tax Code on the Profile tab to something other than your DBT Tax Code, the auto-created Tax Code/Authorities would be auto-deleted and all line items are updated to the newly selected tax rate.

The Suggest Tax button modal has been updated to include Destination Based Tax details. Clicking Look Up Tax Rate for the Ship to Address will display the suggested tax but not assign it to the quote/order. If you wish to use the suggest destination-based tax code you'll click Use This Tax Code.

Using Destination Based Tax (DBT) With Maintenance Contracts

You can choose Destination Based Tax for a Maintenance Contracts by going to the Order Default screen of the original contract setup. Selecting Destination Based Tax here again, uses the Contracts Ship to Address and will assign the necessary Tax Code to any future generated orders created from this Maintenance Contract. Any orders already generated will need to be manually edited to Destination Based Tax on the Profile tab of the order.

Important Note: Evosus will verify every 45 days that the tax rate originally determined from Zip-Tax is still accurate before generating additional orders from the Maintenance Contract.

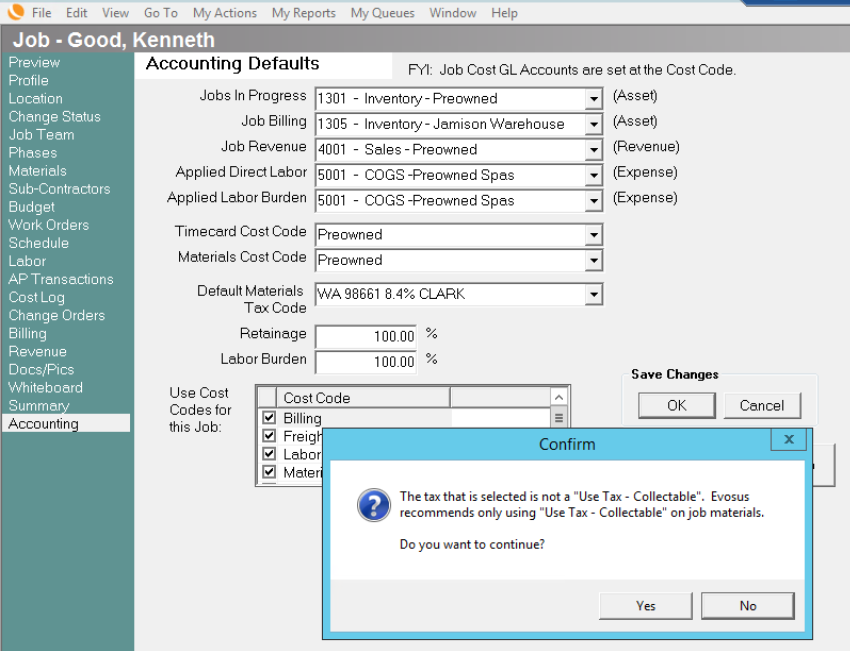

Using Destination Based Tax (DBT) With Jobs

You can choose Destination Based Tax for Job Materials and Job Bills.

When selecting Destination Based Tax as the default Material Tax Code you will receive a warning that Evosus suggests selecting Use Tax for Jobs however you can proceed.

Here is an example of where to choose Destination Based Tax within a Job Bill.

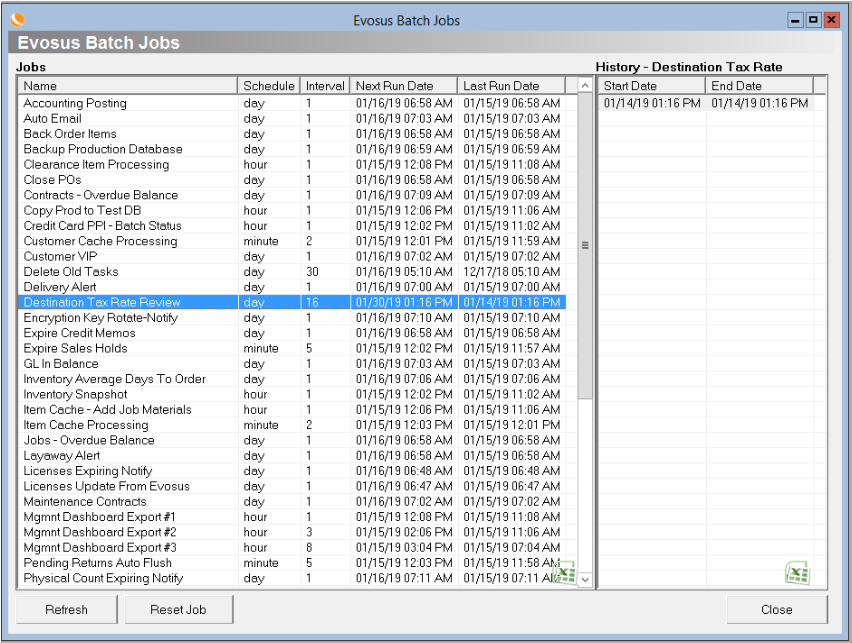

Evosus Daemon Changes for Destination Based Taxes

We've added a Daemon job to handle all the automatic quote and order tax rate reviews to ensure the tax rates are accurate at the time of invoicing based on the most recent information received from Zip-Tax. If an open quote or order comes back with an updated Tax Rate the quote or order amount will be adjusted. This Daemon job will run every 16 days.

Tax Reporting Details

Tax Reporting for Destination Based Tax will continue to use the same formatting as shown in the Tax field of the quote/order Profile Tab, "State - Zip Code - % - County". Evosus Tax Reporting will be broken down by Authority and sorted by zip code.

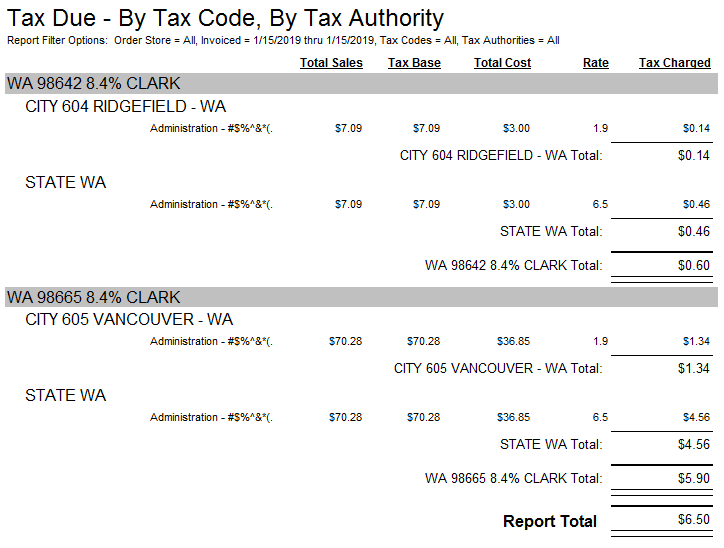

SALES TAX DUE - OUTPUT Report - Summary by Sales Tax -- Two separate transactions are calculated under WA 98665 8.4% Clark. One is calc’d and displayed under WA 98642 8.4% Clark

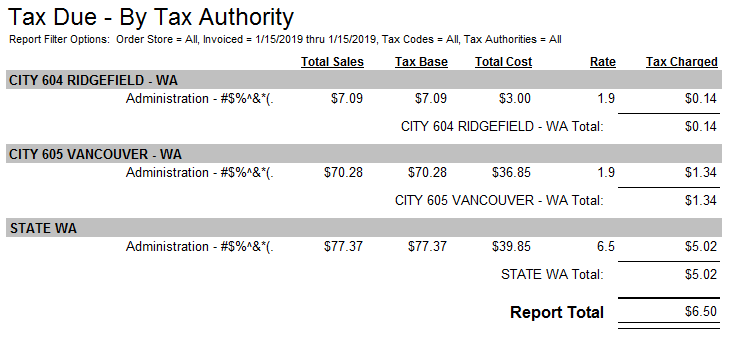

SALES TAX DUE - OUTPUT Report - Summary by Tax Authority - Ridgefield (1) & Vancouver (2) each have their own section. While Washington State holds an amount due for all 3 transactions.

SALES TAX DUE - OUTPUT Report - Detail - Displayed by Tax Code, and within each Tax Code section, Tax Authorities are displayed with accompanying line item charges.