How is a tax code applied to a transaction?

The application determines the appropriate tax code based on the transaction origin and specific information about the customer (for example, the customer's physical location, or exemption status).

- When selecting which tax code to apply to a transaction, the application uses a specific hierarchy. Tax codes with a position higher in the hierarchy will override tax codes with a lower position. For example, if a sales tax is set up on a store and a customer, the sales tax on the customer will be applied because it has a higher position in the hierarchy.

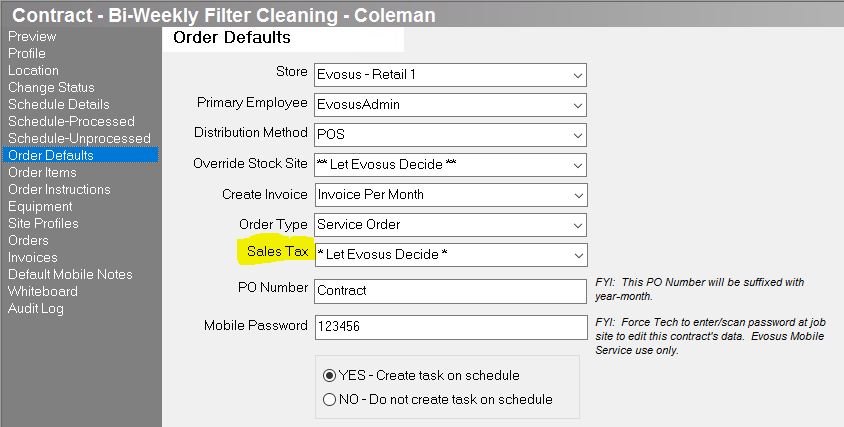

Maintenance contract default tax: You can set the default sales tax on a maintenance contract using the Sales Tax field on the Order Defaults tab of the Contract screen (Administration > Maintenance Contracts > Search Contracts > Open a contract).

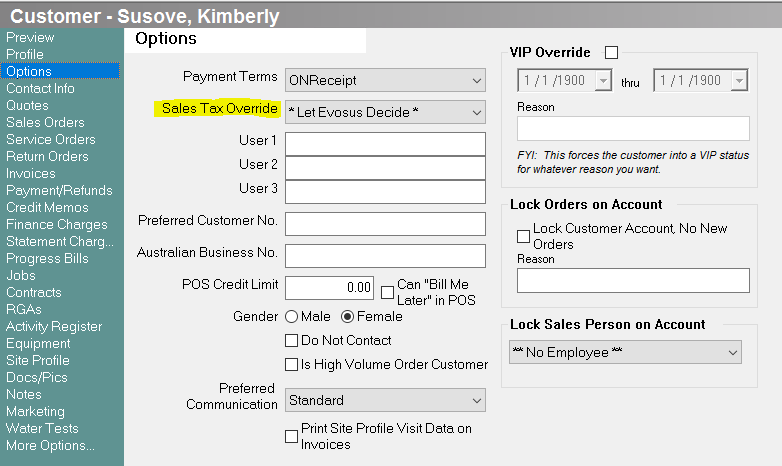

Customer profile default tax: You can set up a default sales tax on a customer using the Sales Tax Override field on the Options tab of the Customer screen (Customer > Open a customer > Options tab). For example, if a customer is tax exempt you can select an exempt tax code. The selected tax code will default on all orders and POS transactions, and it overrides any tax code set up on the store and zip code.

Sales tax postal code default tax: You can use the Tax Code Post Codes screen to assign a sales tax to a single postal code, or a range of postal codes. The application will automatically charge the correct sales tax based on the postal code of the ship to address on a sales order or the postal code of the service location on a service order.

Store default tax: Select a sales tax in the Use in Point-Of-Sale field on the Defaults tab of the Store screen (Administration > System > Stores > Stores > Open a Store > Click Defaults tab to open).

Important Note: Job bills and job materials follow a different hierarchy. In Job Costing, you can either apply tax to the job materials or the job bills.

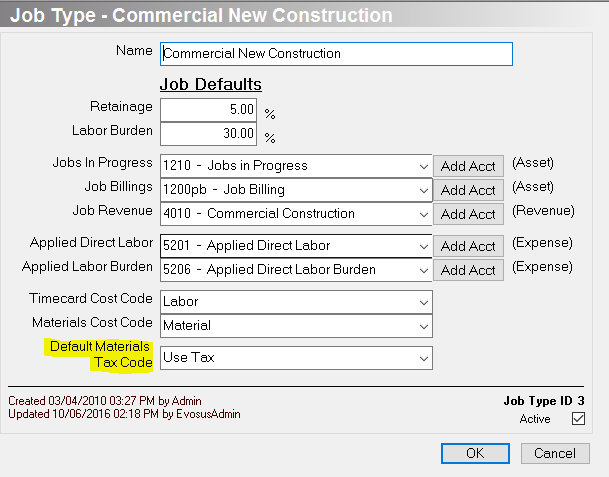

Job Materials: You can set up the tax code on job materials using the Default Materials Tax Code field on the Job Type screen (Administration > Job Costing > General Setup > Job Types > open a Job Type).

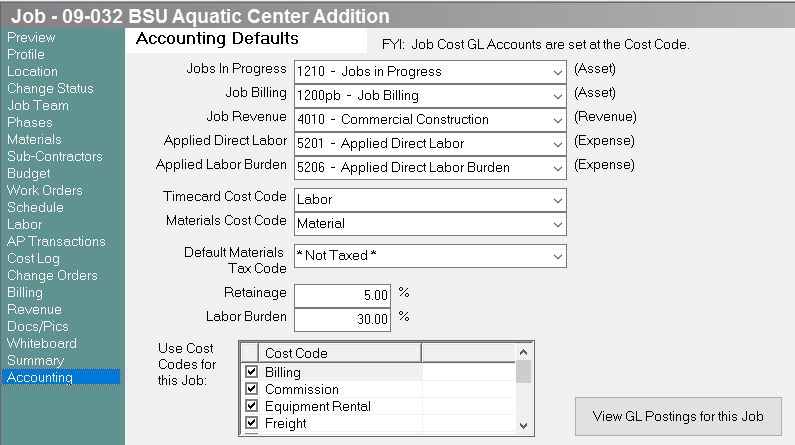

- You can override this tax code on each job using the Default Materials Tax Code field on the Accounting tab of the Job screen

(Administration > Job Costing > Search Jobs > Open a job > Accounting tab).

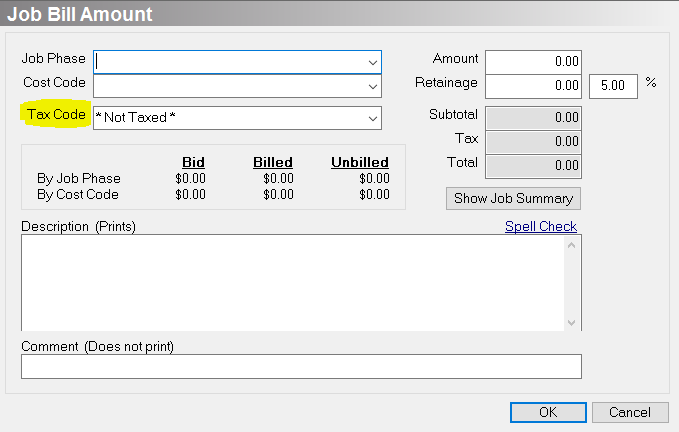

Job Bills: Use the Tax Code field on the Job Bill Amount screen (Administration > Job Costing > Search Job Bills > Open a job bill > click the Billed Ammounts screen > click Add).

Related Video Content: