Reasons - Overview

Accounting reasons are used to capture the specific reason why an adjustment that will affect the general ledger is being recorded. You will create a customized list of accounting reasons that include the following:

-

Stock Adjustment Reasons: Stock adjustment reasons are used to explain why a stock adjustment is being done. Stock Adjustments are associated to specific General Ledger accounts so you can dictate where a stock adjustment will get posted based on the reason for the adjustment. You may also default the posting to the COGS account for the item.

-

Credit Memo Reasons: Determines which GL account is impacted.

-

Discount Reasons: Anytime you discount an item in any type of order or POS transaction you must select a discount reason. The application tracks and reports all discounts by reason and employee.

-

Statement Charge Reasons: Statement charge reasons are added to statement charge, and they determine which GL account the statement charge is posted to.

Create a new stock adjustment reason

-

Open the Stock Adjustment Reason tab on the Administration screen (Administration > Inventory > General Setup > Stock Adjustment Reasons).

-

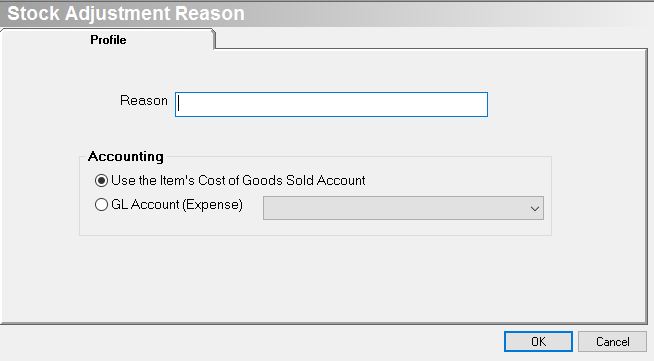

Click Add. The Stock Adjustment Reason screen appears.

-

Reason: Enter a description of the reason. Remember, this is how users will select the stock adjustment reason.

-

Select an accounting option.

- Use the Items Cost of Goods Sold Account: Select this option if you want all stock adjustments with this reason to post to the default COGS account set up at the Product Line level.

- GL Account (Expense): Select a specific GL account if you want all stock adjustments with this reason to post to a specific GL account.

- Click OK when complete to save the stock adjustment reason.

- Merging duplicate inventory items automatically creates a new stock adjustment reason. When you merging duplicate inventory items, the system automatically creates a new stock adjustment reason.

Create a new credit memo reason

-

Open the CR Memo Reason tab on the Accounting Setup screen (Administration > Accounting > General Setup > Credit Memo Reasons).

-

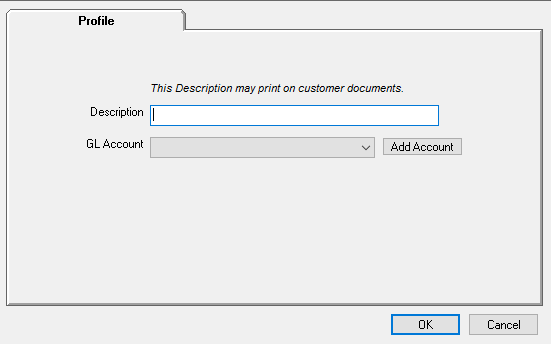

Click Add.

-

Enter a Description of the credit memo.

-

Select a GL Account, or click Add Account to create a new GL account.

-

Click OK when complete.

- Now that the credit memo reason has been created, you can use the New Credit Memo screen to create a credit memo using the new credit memo reason

Create a new discount reason

-

Go to Administration > Sales > General Setup > Discount Reasons.

-

Click Add.

-

Type in the Discount name.

-

Select the Discount GL Account from the pull-down menu.

-

Click OK when complete to save the new discount reason.

Create a new statement charge reason

-

Open the Statement Charges tab on the Accounting Setup screen (Administration > Accounting > General Setup > Statement Charge Reasons).

-

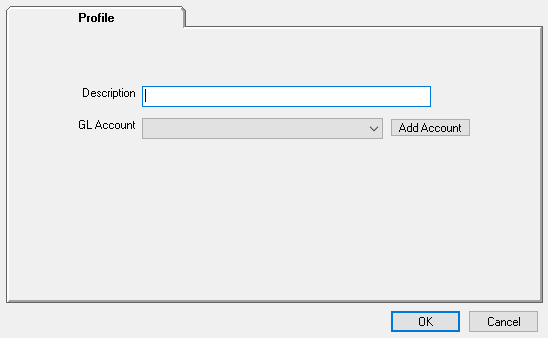

Click Add. The New Statement Charge Reason screen appears.

- Description: Enter a description of the reason, e.g. NSF Fee, Statement Fee or Bounced Check.

- The description prints on the customer statement.

- GL Revenue Account: Select the GL account that is credited when the statement charge is assessed.

- Generally, this is a revenue account, but you can select any account

- Add Account: Click Add Account to create a new account.

-

Click OK when complete. The Reason is now available when adding new Statement Charges.

-

Once you have created a statement charge reason.

Related Video Content: