Receipts Tax - Overview

Receipts Tax

Several states have imposed excise taxes in an attempt to collect revenue from specific sources. An excise tax is, in simplest terms, is a special tax. Since jurisdictions use “Receipts tax” and “Excise tax” interchangeably, we have adopted the term “Receipts Tax” in the software as that is most descriptive of what is actually getting taxed; receipts. Generally speaking, a receipts tax is a rate multiplied by the entire amount collected (tax base) from the customer. It often includes even the tax itself requiring “factored rates” to be applied to the tax base.

Step 1 – Add Tax Authority for Receipts Tax

This process assumes all necessary sales or Use Tax Authorities have already been created. See Evosus Help for how to set up sales or use tax authorities.

-

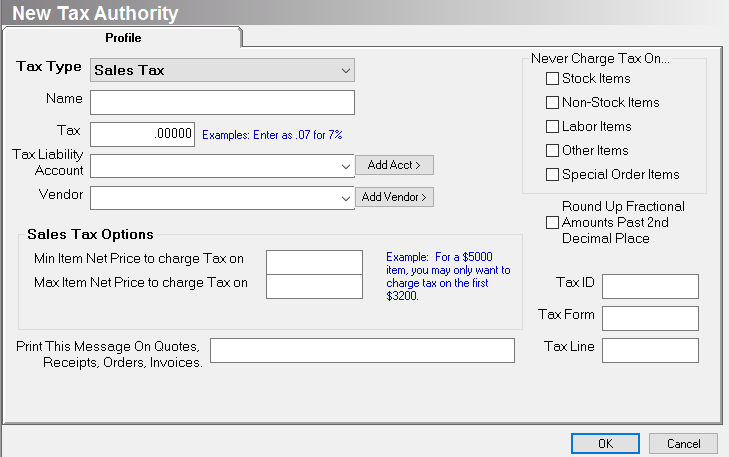

Go to Administration > Accounting > General Setup > Tax Authorities.

-

Click Add.

-

Select “Receipts Tax” from the Tax Type drop down.

-

Enter the name of the tax, such as “SD Excise Tax.”

-

Enter the factored rate into the Tax Rate field.

- In order to charge tax on the Receipts Tax amount, you must enter a factored rate into the Tax Rate field. For instance, the Receipts Tax rate might be 2%, but the factored rate is 2.014%. You would enter .02014 in the Tax Rate field. Factored rates are provided by the jurisdiction.

-

Select the Tax Liability account from the drop-down.

-

Select a Vendor from the drop-down, such as the Washington Department of Revenue.

-

If tax is not applied to a specific type of item, such as Labor or Other, then check the box next to the corresponding Item Type. If the box is checked, Receipts Tax will not be applied to any items with the selected Item Type.

-

Do NOT check the box for “Round Up Fractional Amounts Past 2nd Decimal Place.”

-

Click OK to save.

- If you are updating an existing Tax Authority, you will receive a message indicating all open quotes and orders will be reviewed and, if necessary, recalculated with updated tax information.

Step 2 – Add Receipts Tax to Tax Code

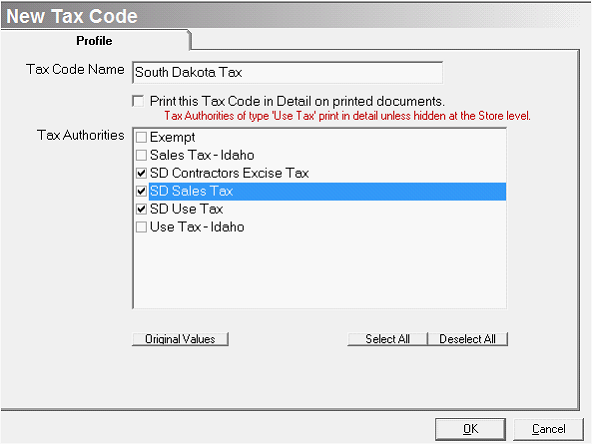

Once the Receipts Tax Authority is set up, you can add the Receipts Tax to the Tax Code.

-

Go to Administration > Accounting > General Setup > Tax Codes.

-

Click Add (or highlight an existing tax code and click Update).

-

Enter the Tax Code Name.

-

Check the box next to all Tax Authorities associated with this Tax Code, including the Receipts tax.

-

Click OK to save.

- If you are updating an existing Tax Code, you will receive a message indicating all open quotes and orders will be reviewed and, if necessary, recalculated with updated tax information.

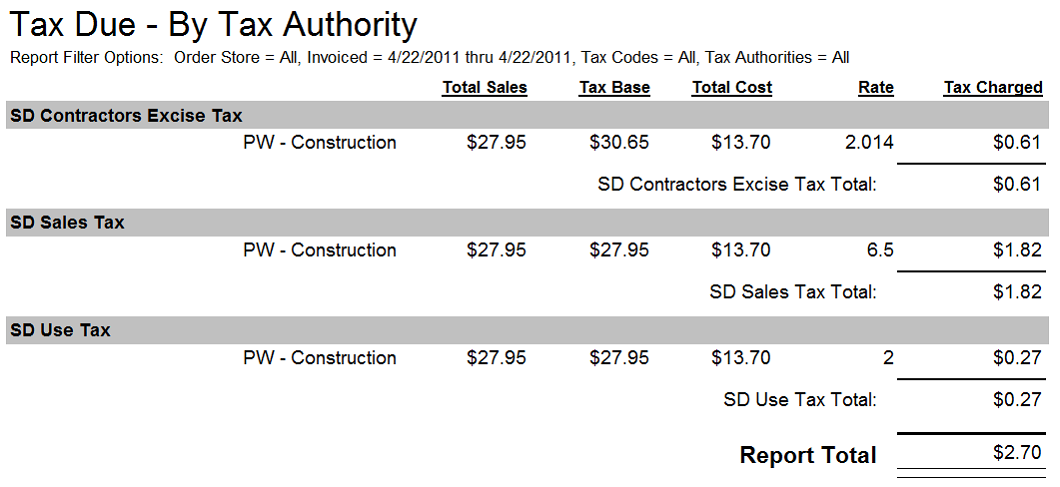

Receipts Tax on Sales Tax Due Report