Recognize Revenue for Multiple Jobs

At some point throughout the job, you will recognize revenue and profit - either as the job progresses (percent complete) or at the completion of the job (completed contract). Recognizing revenue will record earned revenue, actual costs, and profit so the figures can post to the general ledger. Revenue Recognition is a manual process and must be completed prior to closing a job.

-

It is important to differentiate between Job Bills and Revenue Recognition as they are two separate processes.

-

Billing the customer via Job Bills is simply a request for money.

-

Revenue Recognition, on the other hand, means you've completed a specific amount of work and can post the revenue earned from those services.

-

Some users will want to recognize revenue at the same time as creating Job Bills. This is fine, but you must make sure you set up your job as Percent Complete. You can then manually enter the revenue recognition amount rather than using the Evosus calculated amount.

-

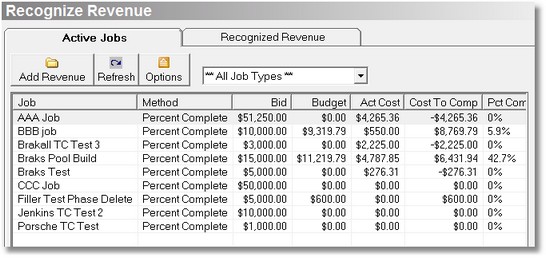

The Revenue Recognition menu option allows you to view and add revenue recognition for all open jobs (Administration > Job Costing > Revenue Recognition).

Active Jobs tab

Displays all jobs in an Open-Active status and allows you to add revenue recognition for any job listed.

Click Add Revenue to recognize revenue for the highlighted job.

Options button:

-

Recognize Revenue: Allows you to recognize revenue for the highlighted job.

-

Add Job Bill: Enter a new job bill for the highlighted job.

-

Go to Job: Opens the highlighted job for viewing and/or editing.

-

Go to Customer: Opens the Customer Profile for the highlighted job.

-

Job Summary: Opens the job summary for the highlighted job.

Recognized Revenue tab

Displays all revenue recognition that has occurred in the selected time frame.

-

By default, the current quarter is selected, but you can use the drop-down menu or arrows to move between quarters.

-

Click View Posting to view GL posting details for the highlighted job revenue recognition.

-

Click Void to cancel the highlighted revenue recognition.

-

Revenue recognition must be voided IN ORDER which means any revenue recognition that occurred BEFORE the highlighted recognition must be voided first. You will then need to re-enter revenue recognition.

Options button:

-

View GL Posting: Allows you to view the GL posting details for the highlighted job revenue recognition.

-

Void Posting: Cancel the highlighted job revenue recognition. If the revenue recognition already posted to the GL, a reversing entry will be made. Revenue recognition must be voided IN ORDER which means any revenue recognition that occurred BEFORE the highlighted recognition must be voided first. You will then need to re-enter revenue recognition.

-

Go to Job: Opens the highlighted job for viewing and/or editing.

-

Go to Customer: Opens the Customer Profile for the highlighted job.

-

Job Summary: Opens the job summary for the highlighted job.

There are two methods for recognizing revenue

#1 Completed Contract - An accounting method used when recognizing revenue on a job. Setting up a job as Completed Contract means you will not recognize any revenue on the job until the job is 100% complete. By default, Evosus will check the "Is Final Job Posting" box when recognizing revenue if Completed Contract is selected.

#2 Percent Complete - An accounting method used when recognizing revenue on a job. Selecting percent complete means you will recognize revenue in stages as the job progresses. You have the option of using the Evosus calculated Revenue figure (based on actual vs budgeted costs) or manually entering a Revenue amount.

Understanding Revenue Recognition

As the job progresses, you assign costs to the job in the form of employee labor (timecards), job materials, vendor invoices, checks and debit memos. These costs post to the Jobs in the Progress asset account. During this time, you will also send the customer bills (invoices) for the current balance due on the job. This amount could be based on the percent complete or a pre-determined amount based on date or phase accomplishments. The frequency and amount of job bills are up to you. Job bills post to a Job Billings contra-asset account and Accounts Receivable.

Percent Complete

If you are using Percent Complete, you will record revenue as the job progresses.

-

Percent Complete Revenue Recognition will post earned revenue and actual costs as of the revenue recognition date according to the current percent complete or the revenue amount you enter. Either way, all actual costs recorded as of the revenue recognition date will be recognized. Until this point, all costs had been going to the Jobs in Progress account.

-

The expense account(s) used for posting costs is determined by the default expense account selected for the cost code on the original transaction (such as AP Invoices or Timecards). Several expense accounts could be affected during a single revenue recognition if multiple cost codes were used.

-

Once the job is complete, you must perform a final revenue recognition to clear out the Jobs in Progress and Job Billings account as well as record any remaining costs or revenue. Final revenue recognition is discussed below with Completed Contract.

How is Percent Complete and Earned Revenue is calculated

-

Percent complete is calculated using Actual Costs/Budgeted Costs = % Complete.

-

Earned Revenue to recognize is calculated as (Percent Complete * Adjusted Bid) - Previous Recognized Revenue

Percent Complete Revenue Recognition Posting

|

GL Account |

Debit |

Credit |

Journal |

|

Jobs in Progress (Profit) |

XXX |

|

Job Journal |

|

Job Revenue |

|

XXX |

Job Journal |

|

Job Expenses (Costs) |

XXX |

|

Job Journal |

Completed Contract and Final Revenue Recognition

If you are using Completed Contract, you will not record revenue until the job is complete. Your one revenue recognition will also be the Final Revenue Recognition. When Completed Contract is selected, the "Is Final" box on the revenue recognition screen is checked by default and cannot be changed.

-

The final Revenue Recognition for both completed contract and percent complete methods will clear out the Jobs in Progress and Job Billing accounts bringing the balance back to zero.

-

All unrecognized revenue, costs, and profit will also be recognized at this time. For Completed Contract jobs, this is ALL revenue, costs, and profit. For Percent Complete, this is anything left over that wasn't previously recognized.

Completed Contract & Final Revenue Recognition Posting

|

GL Account |

Debit |

Credit |

Journal |

|

Final revenue recognition to clear Jobs in Progress and Job Billing: |

|||

|

Job Billing |

XXX |

|

Job Journal |

|

Jobs in Progress |

|

XXX |

Job Journal |

|

Any remaining unrecognized costs, revenue or profit: |

|||

|

Jobs in Progress (Profit) |

XXX |

|

Job Journal |

|

Job Revenue |

|

XXX |

Job Revenue |

|

Job Expenses (Costs) |

XXX |

|

Job Journal |

Security Permissions Required

|

Category |

Function |

|

Job Costing |

Global Search - Revenue Recognition |

|

Job Revenue - Can Add |

|

|

Job Revenue - Can Void |