Trade-In Process

The Trade-In Process

Part 1: Receive Trade-In Spa

- Sell New Spa and discount it for the value of the Trade-In using a "Trade-In" Discount Reason.

-

Set the Discount Reason up under Administration > Sales > General Setup > Discount Reasons and use a unique general ledger account.

- Add the Trade-In Spa as a Stock type item to Evosus using a unique item code/description.

-

The vendor can be "In House."

-

The vendor cost should be the trade-in value.

- Create a Stock Adjustment to add the Trade-In to inventory.

-

Use a unique Stock Adjustment Reason that posts to the same general ledger account as the Trade-In Discount Reason. Stock adjustment reasons can be set-up under Administration > Inventory > General Setup > Stock Adjustment Reasons.

-

Manually add the serial number as In-Stock. Keep in mind that you cannot have duplicate serial numbers, so you may need to add an identifier to the end of the serial number such as Used, Trade, or Refurbished.

- If a Refurbishment: Mark as a demo, set available date, and set as In-Stock. Add Sales and/or Admin Notes that the Serial Number is a Refurbishment in Progress. Move on to Part 2: Track Refurbishment Costs on Trade-In. If the Trade-In Spa isn't a Refurbishment: You're done! Edit the Item options to Track Serial Number on Sale and sell as normal.

Part 2: Track Refurbishment Costs on Trade-In

- Create a Sales Order to track the costs of the refurbishment.

-

Add the Trade-in Spa line item to the Sales Order

-

Add all parts used to repair the spa and mark the items as delivered as the parts are used for repair so that your inventory stays accurate.

-

Add a refurbishment labor line item and add quantity for hours worked. Remember to set your labor item up with a vendor cost in advance so you can track the total cost of the refurbishment later.

-

All line items should have a zero unit price so that the order total remains zero.

- When refurbishment is complete, deliver and invoice the Refurbishment Sales Order in full.

-

This should be a zero dollar invoice.

-

The only costs that will post are the costs of the Spa and Parts. Labor is expensed through payroll.

- Review the total cost, including labor, of the Refurbished Spa in the Sales Order using the Cost/Profit Analysis. Edit the Vendor Cost and Retail Price of the item.

-

Edit the Item Options now to Track Serial Number on Sale.

-

Edit the Serial Number by un-checking the Is-Demo box and edit the Admin and/or Sales Notes.

-

Edit Vendor cost to the total parts cost of the Refurbished Spa. Calculate the retail price using your desired margin and update the retail price of the refurbished spa item.

- Stock Adjust the Refurbished Spa back into Inventory using the Trade-In Stock Adjustment Reason.

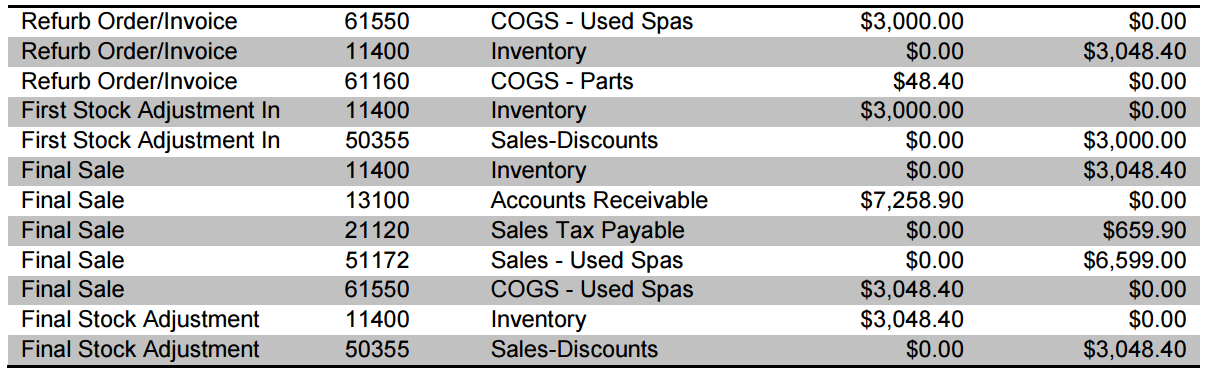

Accounting Implications

-

Trade-in Sale will Debit an Expense or Revenue Account for the Trade-in Value(posts according to the Discount Reason).

-

Stock Adjustment to Add Trade-In to Inventory will debit the Inventory Asset account and credit an expense or revenue account (posts according to the Stock Adjustment reason and should be the same account as the Discount Reason.)

-

Refurb Sales Order will Debit COGS for Spa and parts and Credit an Inventory Asset Account when Invoiced.

-

Stock Adjustment to Add Refurbished Spa back to Inventory will Debit the Inventory Asset account for the total parts amount and Credit the general ledger account associated with the Stock Adjustment Reason.

-

Final Sale of the Refurbished Spa will post a Credit to the Inventory Asset Account and a Debit to COGS for the total of the Spa plus parts.

-

Trade-in Sale will Debit an Expense or Revenue Account for the Trade-in Value ADD SPACE HERE (posts according to the Discount Reason).

See below for a sample posting.